Pay Off Your Mortgage Smarter, Not Longer

The Problem We Solve

You’re stuck in your home loan and not sure what’s really going on.

You don’t know your exact loan status – how much you’ve paid, how much is left, or whether you’re overpaying.

You signed your loan years ago and haven’t reviewed it since.

You feel lost dealing with bank terms, interest rates, or refinancing options.

You want to reduce your monthly commitment but don’t know where to start.

You’re unsure if you’re on the best mortgage plan for your income and goals.

What We Do

Using actuarial principles and financial modeling, we restructure your repayment strategy to:

Slash years off your loan

Minimize total interest paid

Maintain lifestyle and cash flow

Track progress with smart tools

This is mortgage management, reimagined.

Who We Serve

Young homeowners who want to build wealth early

Dual-income families planning long-term financial freedom

Property investors managing multiple loans

Tech-savvy individuals who value optimization

- Homeowners aiming to clear their mortgage ahead of schedule and retire early

Why Choose Us

Science-Backed Approach

No assumptions. Every plan is built using proven actuarial formulas.

Bank-Neutral

We tailor strategies to fit your current bank loan — no refinancing, no new loan applications, no extra hassle.

Fully Transparent

You see the numbers. You understand the strategy. You stay in control.

Real Savings

We guarantee 99% accuracy in effectiveness, delivering real, measurable results.

What We Offer

SmartMortgage99

Think of this like a one-time fitness assessment.

In fitness, you’d measure body fat %, muscle mass, BMI, and strength levels to know exactly where you stand.

With SmartMortgage99, we do a one-time AI-powered mortgage assessment—checking your interest rate health, loan term, repayment efficiency, and cost-saving opportunities.

Just like a check-up tells you your fitness baseline, this service tells you your mortgage’s true condition and how much you could save.

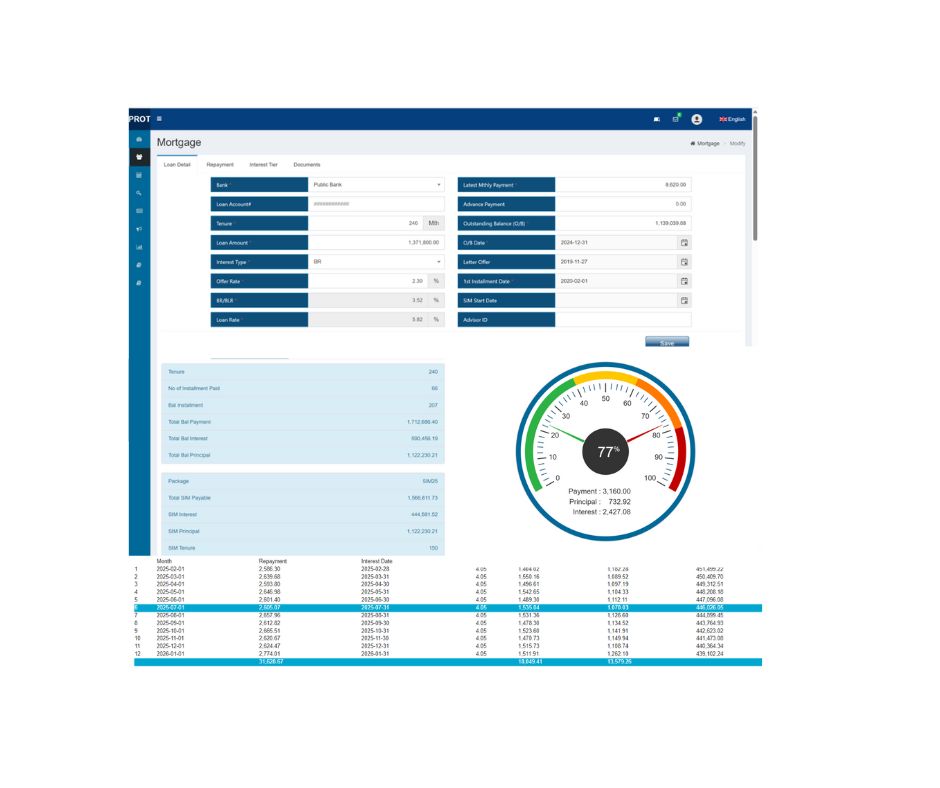

PropTech Mortgage Management System

This is your full fitness program — but for your mortgage.

Imagine having a fully equipped gym, a personal trainer, and a nutritionist guiding you for years.

Our system works the same way:

Structures your mortgage plan for maximum savings

Tracks your progress and adjusts strategies

Keeps you accountable until the results are achieved

Just like a trainer promises muscle gain or fat loss (e.g., reduce body fat by 15%, increase muscle mass by 10% in 6 months), we commit to delivering real, measurable financial results.